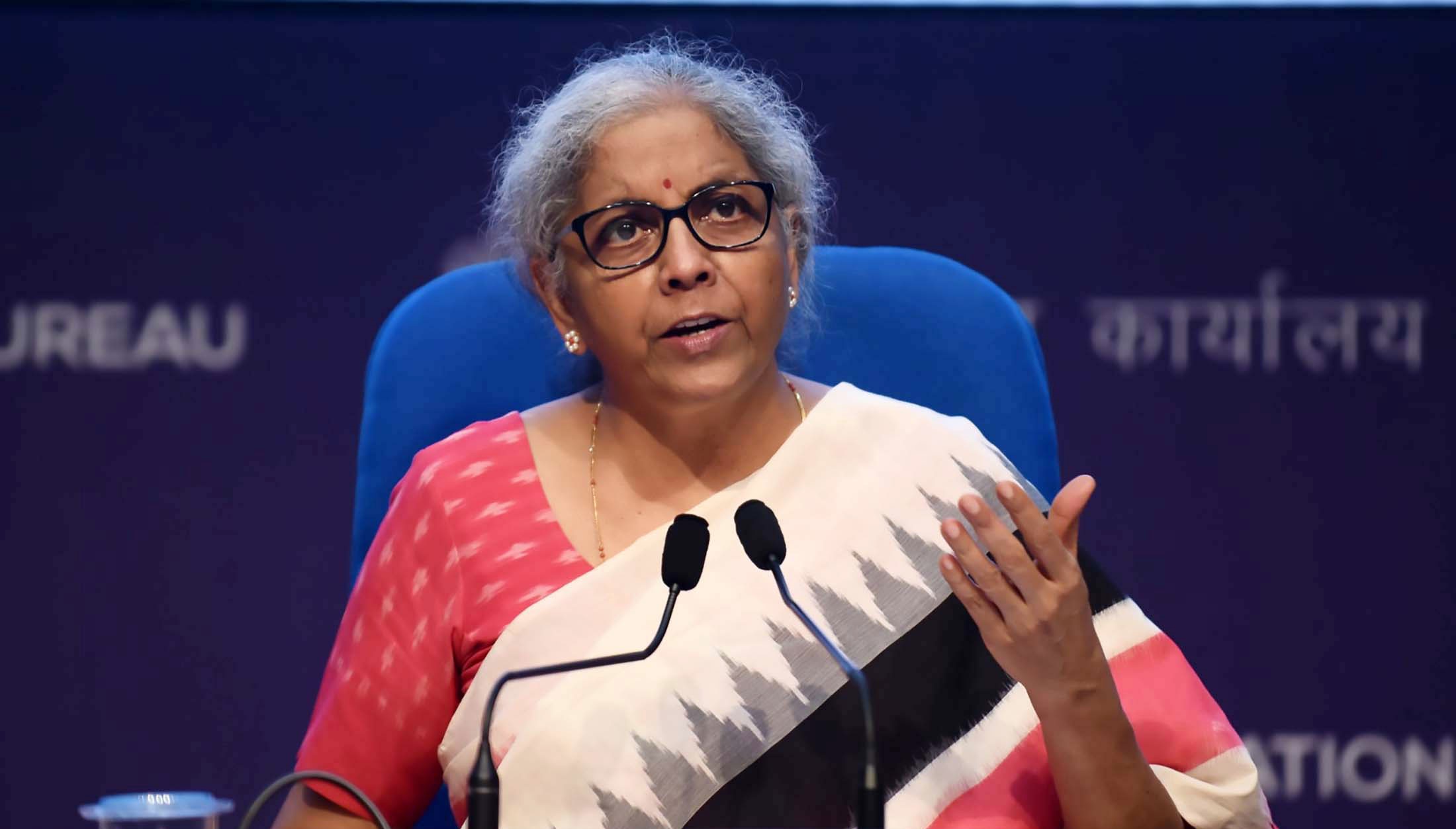

Finance Minister Nirmala Sitharaman Unveils Path For Indian Firms To Access Global Funds Via Direct Foreign Listings

New Delhi, 29th July 2023: Finance Minister Nirmala Sitharaman announced on Friday that Indian companies will now be permitted to directly list on foreign exchanges and the International Financial Services Centre (IFSC) in Ahmedabad. This decision, part of the Covid relief package approved in May 2020, will enable domestic companies to access foreign funds from various overseas exchanges.

Sitharaman expressed her delight at the government’s decision to allow the direct listing of securities by domestic companies in foreign jurisdictions, including the IFSC exchanges. This move is a significant step forward as it will facilitate access to global capital and improve valuation prospects for Indian companies.

A high-ranking government official announced that the regulations concerning the direct overseas listing of Indian companies will be officially disclosed within the coming weeks. Initially, companies will be allowed to list on the IFSC, and later, they will also have the opportunity to list on specified exchanges in seven or eight foreign jurisdictions.

The Finance Minister made this announcement while inaugurating a corporate debt market development fund, designed as a bailout facility for debt funds during periods of market stress. The fund, recently announced by the Securities and Exchange Board of India (SEBI), will function by purchasing investment-grade corporate debt securities in times of crisis. This move is expected to boost confidence among mutual funds and investors in the corporate debt markets while enhancing liquidity in the secondary market for corporate debt securities.

Currently, Indian firms seeking foreign listings follow the process of making a secondary listing on domestic equity bourses or first going for a domestic float. However, the new policy opens up the possibility of direct overseas listings, which could prove beneficial for unicorns and startups valued at over USD 1 billion, as well as the digital unit of Reliance conglomerate, which is eyeing a US listing after raising substantial investments.

Previously, there were reports that the government was considering permitting foreign listings in seven countries, including the UK, Canada, Switzerland, and the US. SEBI had proposed a framework for direct listings on stock exchanges in ten “permissible jurisdictions” with robust anti-money laundering regulations, including major exchanges like NYSE, Nasdaq, LSE, and Hong Kong, along with exchanges in Japan, South Korea, France, Germany, Switzerland, and Canada.

Overall, these measures are expected to provide Indian companies with greater access to global capital markets, promote investment, and bolster the country’s economic growth prospects.